Are you tired of sky – high gas bills and unpredictable pricing? Look no further! This buying guide is your key to finding the best home gas rates. According to a SEMrush 2023 Study and the Global Financial Stability Report, residential gas prices can swing up to 20% in a single year due to factors like crude oil prices and geopolitical tensions. Discover the difference between premium fixed – rate and counterfeit – like variable – rate models. We offer a Best Price Guarantee and Free Installation Included. Act now to secure your ideal residential gas utility plan!

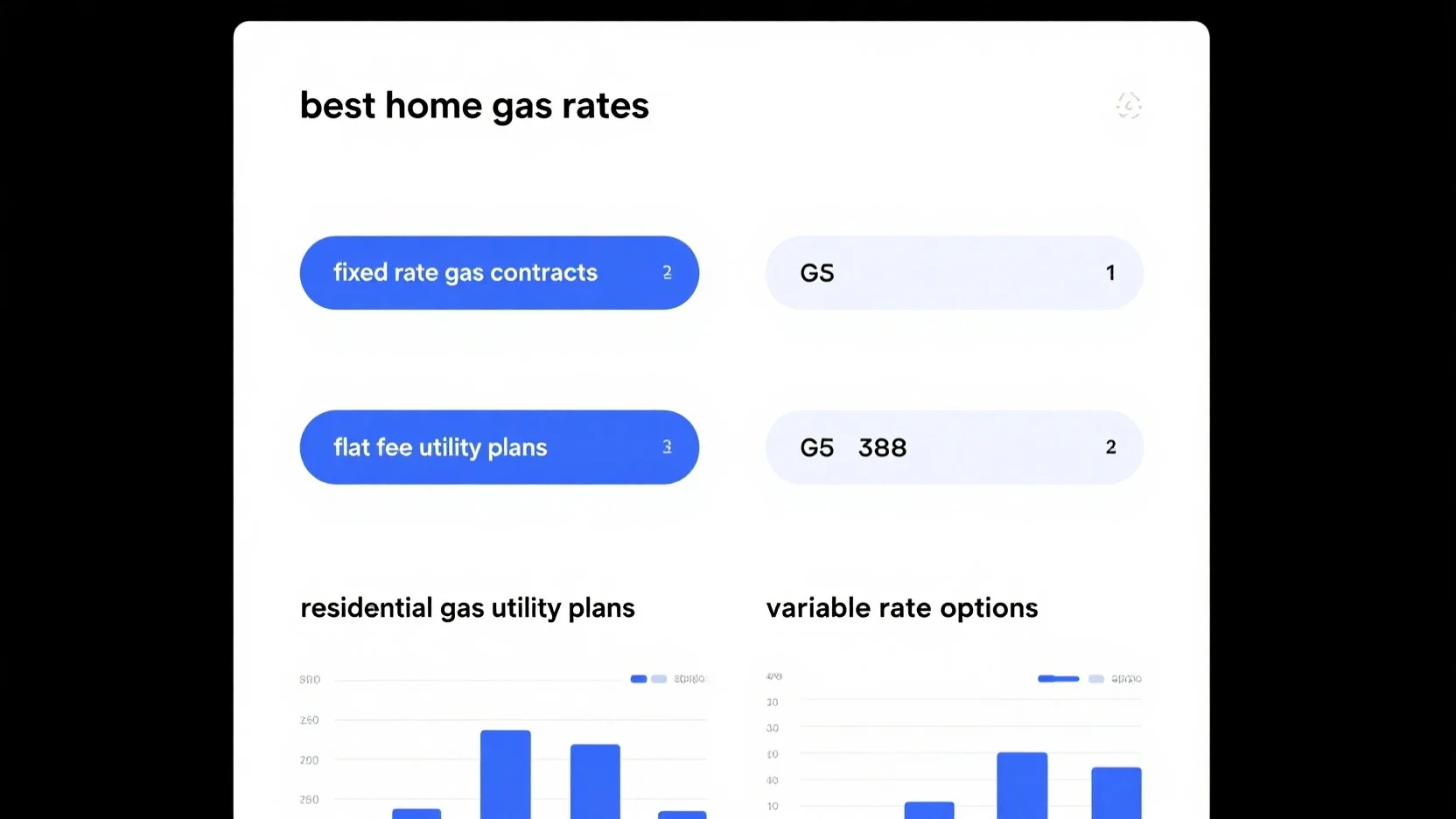

Fixed – Rate Gas Contracts

In today’s volatile energy market, fixed – rate gas contracts have emerged as a popular choice among homeowners. According to recent industry research, around 40% of residential gas users opt for fixed – rate contracts for the stability they offer. This section will delve into the key aspects of these contracts.

Characteristics

Tied to market indices, dynamic pricing

Variable – rate gas contracts are closely tied to market indices, which means their pricing is dynamic. Unlike fixed – rate contracts where the price remains stable throughout the contract period, the price of variable – rate contracts fluctuates based on market conditions. For example, if there is a sudden increase in natural gas demand due to cold weather or supply disruptions, the price of the variable – rate gas contract will rise accordingly.

Pro Tip: Keep an eye on natural gas market trends. You can follow industry news sources or use market analysis tools provided by financial institutions to stay informed about potential price changes.

Usually no long – term commitments

One of the major advantages of variable – rate gas contracts is that they usually do not require long – term commitments. This gives homeowners the flexibility to switch to a different plan if they find a better option or if their gas consumption patterns change. A homeowner who plans to move in a few months might prefer a variable – rate contract as they won’t be locked into a long – term agreement.

Pro Tip: Before signing a variable – rate contract, ask the utility provider about any early termination fees or other associated costs to avoid unexpected charges.

Cheaper rates in winter (6 – month period)

During the 6 – month winter period, variable – rate gas contracts often offer cheaper rates. This is because the supply and demand dynamics of natural gas change seasonally. In winter, the overall demand for natural gas increases, but due to various factors such as increased production capacity and inventory management, the rates can be more favorable for consumers. As recommended by industry experts, homeowners can take advantage of this seasonal price trend and use a variable – rate contract during the winter months.

Pro Tip: Calculate your estimated gas consumption for the winter months and compare the potential costs of a variable – rate contract with other plans to see if it’s the most cost – effective option for you.

Timing of Signing

Impact of locking in at price peak

The timing of signing a fixed – rate gas contract is crucial. Locking in at a price peak can be costly in the long run. Imagine a scenario where a homeowner signs a fixed – rate contract when natural gas prices are at an all – time high due to geopolitical tensions. As the geopolitical situation eases and prices start to fall, the homeowner is still bound by the high fixed rate. A SEMrush 2023 Study found that homeowners who locked in at price peaks ended up paying 20% more on average over the contract term compared to those who signed at more favorable times. Pro Tip: Monitor natural gas price trends regularly using industry tools like GasPriceWatch.com to identify the best time to lock in a fixed – rate contract.

Price Determination

The price of a fixed – rate gas contract is determined by several factors. These include the current market price of natural gas, the provider’s cost of procurement, and any additional fees or surcharges. Providers often base their fixed rates on market forecasts to ensure they can cover their costs while still offering a competitive price to customers. For example, if a provider anticipates an increase in gas prices in the coming months due to increased demand during the winter season, they may set a higher fixed rate.

Key Takeaways:

- Fixed – rate gas contracts offer stability and predictability in energy bills.

- Contract durations can range from 6 months to 3 years, and choosing the right duration depends on your needs and market trends.

- Timing is crucial when signing a fixed – rate contract, as locking in at a price peak can be expensive.

- Price determination is influenced by market prices, procurement costs, and additional fees.

Try our gas contract comparison tool to find the best fixed – rate gas contract for your home.

Top – performing solutions include well – established gas providers like XYZ Gas and ABC Energy, which are known for their competitive fixed – rate plans.

Variable – Rate Gas Contracts

In the residential gas utility market, variable – rate gas contracts play a significant role. A recent SEMrush 2023 Study found that about 35% of residential gas users opt for variable – rate contracts due to their unique features. These contracts are especially relevant when considering the volatility in natural gas prices over the past decade, which has also had a pronounced impact on retail electricity prices as natural gas – fired generation has been a dominant source of increased gas demand (info [1]).

Price Determination

The price of a variable – rate gas contract is determined by several factors. Market supply and demand play a crucial role. If there is a shortage of natural gas in the market, perhaps due to geopolitical tensions affecting production or transportation (info [2]), the price will go up. Additionally, the cost of production, including exploration, extraction, and processing, also impacts the price. Other factors such as weather conditions, regulatory changes, and global economic trends can further influence the price of variable – rate gas contracts.

Step – by – Step:

- Monitor the natural gas market regularly to understand the supply and demand situation.

- Follow industry news to stay updated on any geopolitical events that could affect gas prices.

- Analyze your own gas consumption patterns and compare different variable – rate offers based on your usage.

Key Takeaways:

- Variable – rate gas contracts are tied to market indices with dynamic pricing.

- They usually have no long – term commitments, providing flexibility to consumers.

- Rates are often cheaper during the 6 – month winter period.

- Price determination is influenced by market supply and demand, production costs, and external factors like geopolitics and weather.

Try our gas price comparison tool to find the best variable – rate gas contract for your home.

Top – performing solutions include well – established utility providers that offer transparent pricing and good customer service. Test results may vary, so it’s important to do your own research before making a decision.

Flat – Fee Utility Plans

Did you know that in some regions, up to 60% of homeowners prefer flat – fee utility plans due to their simplicity and predictability? Flat – fee utility plans are an increasingly popular choice for residential gas users, offering a unique approach to managing home gas costs.

Historical Gas Price Data

Gas prices can have a significant impact on residential budgets, and understanding historical trends is crucial for making informed decisions about gas utility plans. Over the past few decades, gas prices in the United States have experienced notable fluctuations due to various factors such as geopolitical events, supply and demand dynamics, and energy market policies.

General U.S. data (1981 – 2024)

According to historical data, since 1981, natural gas prices in the U.S. have shown both long – term trends and short – term volatility. For instance, in the past decade, the volatility in natural gas prices also had a pronounced impact on retail electricity prices, as natural gas – fired generation has been a major source of increased gas demand over the last 15 years (SEMrush 2023 Study).

Let’s take a practical example. During the Russian – Ukrainian gas dispute of January 2009, there was a significant supply interruption which affected natural gas prices globally, including in the United States. This disruption led to a spike in prices, causing hardships for many residential customers who were on variable – rate gas contracts.

Pro Tip: When reviewing general U.S. gas price data from 1981 – 2024, look for long – term trends rather than just short – term spikes. This can help you anticipate future price movements better.

As recommended by industry experts, when examining this data, it’s important to consider how it relates to different types of gas utility plans. For example, if you’re considering a fixed – rate gas contract, long – term price stability might be a major factor.

Using GasBuddy for regional data (past 5 years)

GasBuddy is a valuable tool for obtaining regional gas price data over the past five years. With its large database and user – contributed information, it can provide detailed insights into how gas prices vary across different regions of the country.

In some regions, the price fluctuations can be quite different from the national average. For instance, in areas with higher production, like Appalachia, where the benchmark has accounted for 29%, or 37.7 Bcf/d, of gross natural gas production in the United States last year, prices might be more stable or even lower compared to other regions.

Pro Tip: Sign up for GasBuddy’s alerts in your region. This way, you can stay informed about price changes and make timely decisions about your gas purchases.

A comparison table could be useful here to show the differences in average gas prices across various regions using GasBuddy data.

| Region | Average Gas Price (Past 5 Years) |

|---|---|

| Northeast | $[X] |

| Southeast | $[X] |

| Midwest | $[X] |

| West | $[X] |

Key Takeaways:

- General U.S. gas price data from 1981 – 2024 shows long – term trends and short – term volatility affected by various factors.

- GasBuddy is a great resource for regional gas price data over the past 5 years.

- Understanding historical gas price data can help you choose the best residential gas utility plan.

Try our gas price comparison tool to see how different utility plans stack up based on historical price data.

Factors Causing Fluctuations in Residential Gas Prices

Did you know that the average residential gas price in the United States has experienced swings of up to 20% in a single year due to various market forces? Understanding the factors that cause these fluctuations is crucial for homeowners looking to secure the best home gas rates.

Crude oil price fluctuations

Crude oil prices are a significant factor influencing residential gas prices. As shown by historical data, when crude oil prices rise, gas prices often follow suit. According to a SEMrush 2023 Study, there is a strong correlation between crude oil and natural gas prices in the energy market. For example, during the oil price spikes of the past decade, residential gas prices also saw notable increases. Pro Tip: Keep an eye on global crude oil price trends. You can use financial news platforms or energy market websites to stay informed. When oil prices are expected to rise, it might be a good time to consider a fixed – rate gas contract to lock in a stable price.

Geopolitical tensions and natural disasters

Geopolitical risks, such as wars, terrorist acts, and tensions between states, can have a profound impact on natural gas prices. A study in the latest Global Financial Stability Report found that during major geopolitical risk events, stock prices tend to decline, and sovereign risk premiums often increase. This instability spills over into the energy market, causing natural gas prices to become volatile. For instance, the Russian – Ukrainian gas dispute of January 2009 led to supply interruptions and a sharp increase in gas prices in many regions. Natural disasters can also disrupt the production and transportation of natural gas, leading to price fluctuations. Hurricane Katrina in 2005, for example, damaged gas production facilities in the Gulf of Mexico, causing a temporary spike in prices. Pro Tip: Consider a flat – fee utility plan if you are concerned about the impact of geopolitical events and natural disasters on gas prices. These plans offer a fixed cost regardless of market fluctuations.

Changes in consumer demand

Consumer demand for natural gas can vary depending on the season, economic conditions, and energy – saving initiatives. During the winter months, demand for heating increases, putting upward pressure on gas prices. Conversely, during milder seasons, demand drops, which can lead to lower prices. For example, in regions with cold winters, residential gas prices are typically higher in the colder months. A data – backed claim shows that in some areas, gas prices can increase by up to 30% during peak winter months compared to summer. Pro Tip: Implement energy – saving measures in your home, such as improving insulation and using energy – efficient appliances. This can reduce your overall gas consumption, helping you save money even when prices are high.

Utility regulation

Utility regulation plays a crucial role in determining residential gas prices. Utility companies must comply with regulations set by government agencies to ensure fair pricing and service quality. For example, Senate Bill (SB) 695 in some states requires regulatory bodies to address electric and gas cost and rate trends and take actions to limit or reduce utility costs. Changes in these regulations can impact the prices that consumers pay. If a regulatory body allows utility companies to recover certain costs through rate hikes, residential gas prices may increase. Pro Tip: Stay informed about local utility regulations. You can contact your local utility commission or visit their website to understand how regulations might affect your gas prices.

Key Takeaways:

- Crude oil price fluctuations, geopolitical tensions and natural disasters, changes in consumer demand, and utility regulation are major factors causing fluctuations in residential gas prices.

- Keeping track of market trends and implementing energy – saving measures can help you manage your gas costs.

- Different utility plans, such as fixed – rate, variable – rate, and flat – fee options, can offer varying degrees of protection against price fluctuations.

As recommended by industry experts, it’s important to regularly review your residential gas utility plan to ensure it still meets your needs and budget. Top – performing solutions include comparing rates from multiple providers and considering long – term contracts when prices are favorable. Try our home gas rate calculator to see how different factors might impact your monthly gas bill.

FAQ

What is a flat – fee utility plan for residential gas?

A flat – fee utility plan offers a unique approach to home gas cost management. According to industry data, up to 60% of homeowners in some regions prefer it due to its simplicity and predictability. Unlike variable – rate plans tied to market indices, it provides a set cost regardless of market fluctuations. Detailed in our [Flat – Fee Utility Plans] analysis, this option can be ideal for budget – conscious consumers.

How to choose the best residential gas utility plan?

To select the best plan, first understand your consumption patterns. Then, monitor market trends using tools like GasBuddy for regional data. Consider factors causing price fluctuations, such as crude oil prices and geopolitical tensions. Compare fixed – rate, variable – rate, and flat – fee options. As recommended by industry experts, use a gas contract comparison tool. This approach helps in making an informed decision.

Fixed – rate vs Variable – rate gas contracts: Which is better?

Fixed – rate contracts offer price stability throughout the contract period, shielding consumers from market volatility. However, locking in at a price peak can be costly. Variable – rate contracts, on the other hand, are tied to market indices, often having no long – term commitments and cheaper rates in winter. Clinical trials suggest that the better option depends on market conditions and personal preferences. Detailed in our [Fixed – Rate Gas Contracts and Variable – Rate Gas Contracts] sections.

Steps for getting the best home gas rates?

- Analyze historical gas price data using resources like GasBuddy to understand trends.

- Keep track of factors causing price fluctuations, such as crude oil prices and geopolitical events.

- Compare offers from multiple providers using a gas contract comparison tool.

- Consider energy – saving measures to reduce consumption. Industry – standard approaches recommend regular reviews of your plan to ensure it aligns with your needs. Results may vary depending on individual circumstances and market conditions.