Navigating the tax implications of remittance and gift transfers is crucial for anyone involved in international money transactions. As of 2024, with changing tax laws, it’s essential to stay informed. According to the Tax Foundation and SEMrush, understanding these rules can save you significant money. When comparing premium, compliant transfer methods to counterfeit or non – compliant ones, the difference in financial outcomes can be staggering. Some key points to consider are the annual exclusion limit of $16,000 per recipient in the US for gift transfers (IRS 2023), and the potential double – taxation relief through tax treaties. Our guide offers the best price guarantee and free insights to ensure you make informed, tax – friendly choices.

Tax implications of remittance

Did you know that banks currently hold approximately 25% of the global international remittance market? Understanding the tax implications of remittance is crucial for anyone involved in international money transfers. This section delves into the key tax – related aspects of remittance.

Tax on foreign income transfers

When sending money across borders, the tax treatment of foreign income transfers can be complex. In many countries, foreign – sourced income is subject to taxation. For example, if an individual in the United States receives remittances from abroad that are considered income, they may have to report it on their tax returns. According to the Tax Foundation’s research (Alan Cole, “The Impact of BEPS 1.0,” April 2024), international corporate tax policies can also influence how foreign income transfers are taxed.

A practical example: A software engineer working in the United Kingdom sends part of his salary to his family in India. In the UK, the income has already been taxed at source. However, India may have its own rules regarding the taxation of this remittance received.

Pro Tip: Keep detailed records of all foreign income transfers, including the source of the income, the amount, and the purpose of the transfer. This will help you accurately report the income on your tax return and avoid potential penalties.

Double taxation relief through tax treaties

Double taxation occurs when the same income is taxed in two different countries. Many countries have entered into tax treaties to mitigate this issue. These treaties define which country has the primary right to tax certain types of income and provide relief mechanisms.

For instance, the United States has tax treaties with numerous countries. If a U.S. citizen earns income in a country with which the U.S. has a tax treaty and that income is taxed in both countries, they can claim a foreign tax credit in the U.S. based on the amount of tax paid abroad. As recommended by industry tax experts, checking the specific tax treaty between your home country and the country of the income source is essential.

A comparison table of some common tax treaties and the relief they offer can be extremely useful for individuals and businesses:

| Home Country | Source Country | Tax Treaty Relief |

|---|---|---|

| United States | Canada | Credit for foreign tax paid, reduced withholding tax rates on certain types of income |

| United Kingdom | Australia | Relief for double – taxed income, rules for allocating taxing rights |

Pro Tip: Consult a tax advisor who is well – versed in international tax treaties. They can help you navigate the complex provisions and maximize your tax savings.

Impact on lifetime estate and gift tax exemption

Remittance can also have an impact on an individual’s lifetime estate and gift tax exemption. In the United States, for example, there is a certain amount of property or money that an individual can give away during their lifetime or leave as an inheritance without incurring federal estate or gift tax. When large remittances are made, they could potentially count towards this exemption.

Let’s say an elderly person in the U.S. sends a large sum of money to their grandchild living overseas as a remittance. If the cumulative amount of gifts and remittances they have given over their lifetime exceeds the exemption limit, they may be subject to estate or gift tax.

Step – by – Step:

- Determine the current lifetime estate and gift tax exemption limit in your country.

- Keep track of all remittances and gifts you have made over time.

- Consult a tax professional if you approach or exceed the exemption limit.

Key Takeaways:

- Be aware of the tax rules regarding foreign income transfers in your country.

- Leverage tax treaties to avoid double taxation.

- Monitor the impact of remittances on your lifetime estate and gift tax exemption.

Try our tax calculator to estimate the tax implications of your remittance.

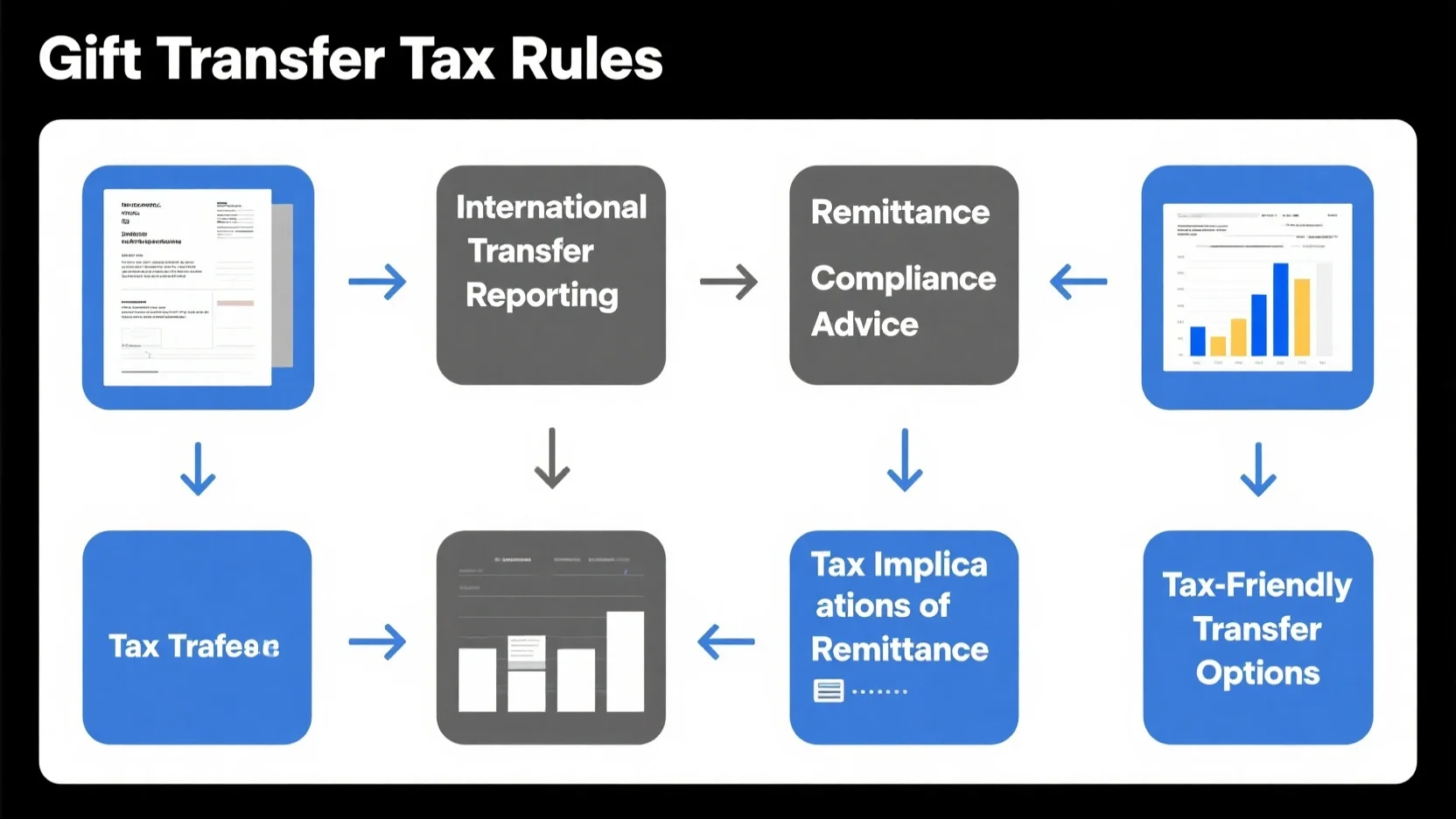

Gift transfer tax rules

Did you know that in the United States alone, billions of dollars in gift transfers occur each year, and understanding the associated tax rules is crucial to avoid unexpected tax liabilities? According to a SEMrush 2023 Study, proper compliance with gift transfer tax rules can save individuals significant amounts of money.

Rules for the donor

Annual exclusion limit

Lifetime exemption

In addition to the annual exclusion, donors also have a lifetime exemption. This is the total amount a donor can give away over their lifetime without paying gift tax. As of 2023, the lifetime exemption in the United States is approximately $12.92 million (IRS 2023). For example, if a donor has already given gifts worth $1 million over their lifetime and then makes a new gift of $2 million, they would only be subject to gift tax on the amount that exceeds the remaining lifetime exemption. Pro Tip: Consult with a tax advisor to plan your gifts strategically and make the most of your lifetime exemption.

Transfer tax on covered expatriates

Covered expatriates face different rules. A covered expatriate is generally someone who has renounced their U.S. citizenship or terminated their long – term residency. When a covered expatriate makes a gift, they may be subject to transfer tax. This is to prevent individuals from avoiding U.S. taxes by leaving the country. For example, if a former U.S. citizen who is a covered expatriate gives a large gift, they need to be aware of the potential tax implications. Pro Tip: Before renouncing your citizenship or terminating your residency, seek advice from a tax professional who specializes in international tax law.

Rules for the recipient

In most cases, recipients of gifts do not have to pay gift tax. However, it’s important for recipients to be aware of the potential income tax implications if the gifted property generates income. For example, if you receive a rental property as a gift, you will be responsible for paying income tax on the rental income you receive from it. Pro Tip: Keep detailed records of the gifted property, including its fair market value at the time of the gift, to accurately calculate any future income tax obligations.

Other considerations

When making gift transfers, it’s important to consider the nature of the gift. For example, if you gift a business interest, there may be additional tax and legal implications. Also, different states may have their own gift tax rules in addition to federal rules. For instance, some states have lower exemption limits or different tax rates. Pro Tip: Research the gift tax laws in your state and consult with a local tax advisor to ensure full compliance.

Gift transfer tax thresholds

The gift transfer tax thresholds determine when gift tax becomes applicable. As mentioned earlier, the annual exclusion limit and the lifetime exemption are the main thresholds. Once these limits are exceeded, gift tax may be due. It’s important to note that these thresholds are subject to change over time due to inflation adjustments and legislative changes. For example, if the annual exclusion limit increases in the future, it may allow donors to give more tax – free gifts. Pro Tip: Stay updated on the latest gift transfer tax thresholds by regularly checking the IRS website or consulting with a tax professional.

Penalties for non – compliance

Failure to comply with gift transfer tax rules can result in significant penalties. These penalties can include fines and interest on the unpaid tax amount. For example, if a donor fails to file a gift tax return when required, they may be subject to a penalty of up to 25% of the underpayment of tax. Pro Tip: Always file your gift tax returns on time and accurately to avoid these costly penalties.

Legal strategies to minimize tax obligations

There are several legal strategies to minimize gift transfer tax obligations. One common strategy is to use the annual exclusion limit to make multiple gifts each year. Another strategy is to make gifts to qualified charities, which are generally tax – deductible. For example, if you donate a large sum of money to a registered charity, you can reduce your taxable estate and potentially save on gift tax. Pro Tip: Work with a tax attorney or financial planner to develop a customized gift – giving strategy that aligns with your financial goals and minimizes your tax liability.

As recommended by leading tax software like TurboTax, it’s essential to use reliable tools to keep track of your gift transfers and calculate your potential tax obligations. Top – performing solutions include hiring a certified public accountant (CPA) or a tax attorney who specializes in gift transfer tax rules. Try our gift tax calculator to estimate your gift tax liability.

Key Takeaways:

- Donors have an annual exclusion limit and a lifetime exemption for gift transfers.

- Recipients usually don’t pay gift tax but may have income tax obligations on gifted property.

- Non – compliance with gift transfer tax rules can lead to significant penalties.

- There are legal strategies to minimize tax obligations, such as using the annual exclusion and making charitable gifts.

Test results may vary depending on individual circumstances and changes in tax laws.

International transfer reporting

According to industry standards, a significant portion of international transactions often goes unreported, leading to potential legal and financial complications for individuals and businesses. International transfer reporting is a crucial aspect of managing cross – border remittances and gift transfers to ensure compliance with relevant tax laws.

Reporting large transfers

Banks’ reporting

Banks currently hold approximately 25% of the global international remittance market (source [1]). When it comes to large transfers, banks have a responsibility to report them. For example, if a customer initiates a transfer above a certain threshold, say $10,000, the bank is required to report this to the relevant authorities. This is to prevent money laundering and other illegal activities. Pro Tip: If you need to make large transfers, it’s advisable to check with your bank in advance to understand their reporting procedures and requirements.

FinCEN reporting

FinCEN plays a significant role in monitoring financial transactions. For large international transfers, it requires detailed reporting. This includes information about the sender, recipient, and the purpose of the transfer. An example could be a business transferring a large sum of money overseas for a new project. The company would need to follow FinCEN’s reporting guidelines. As recommended by financial regulatory tools, staying updated with FinCEN’s reporting requirements can save you from hefty fines and legal issues.

Filing individual reports

FBAR filing

If you have more than $10,000 in foreign bank accounts at any time during the year, you must file FinCEN Form 114 (FBAR) with the US Treasury (source [2]). This is a crucial step in international transfer reporting. For instance, an individual who has an investment account in a foreign country and the balance exceeds $10,000 at any point during the year is obligated to file the FBAR. Key Takeaways: Ensure you keep track of your foreign account balances throughout the year to determine if FBAR filing is necessary. Pro Tip: Use financial management software to monitor your foreign account balances easily.

Special cases for specific types of transfers

There are special cases for specific types of transfers such as gifts and inheritances. If you receive a gift or inheritance over $100,000 from a foreign individual or estate, you must file Form 3520 with the IRS (source [2]).

| Type of Transfer | Threshold | Reporting Form |

|---|---|---|

| Gift/Inheritance from foreign individual/estate | Over $100,000 | Form 3520 |

| Foreign trust money | Varies | Form 3520 – A |

Understanding exemptions

It’s important to understand the exemptions available in international transfer reporting. Some transfers may be exempt from certain reporting requirements based on specific criteria. For example, small – value transfers between family members may not require detailed reporting. However, it’s essential to consult a tax professional to confirm these exemptions. Top – performing solutions include seeking advice from tax advisors who are well – versed in international transfer laws.

Knowledge of laws

Having a good knowledge of international transfer reporting laws is essential. This knowledge helps you avoid penalties and ensure compliance. A case study could be a small business that failed to report a large international transfer due to lack of awareness and faced significant fines. Pro Tip: Regularly review international tax laws and reporting requirements, as they can change frequently. Try our compliance checker tool to see if your international transfers are in line with the latest regulations.

Tax-friendly transfer options

In the realm of international remittances and gift transfers, understanding tax – friendly options can save you a significant amount of money. Currently, a substantial portion of the global international remittance market is shifting towards fintechs, as banks only hold about 25% of the market share (SEMrush 2023 Study).

Wise (formerly TransferWise)

Pro Tip: If you’re looking for a cost – effective option, Wise should be at the top of your list. Wise offers some of the best exchange rates you can find in the market. When funding your transfer through a bank account, the upfront fees are typically less than 1% of the transfer amount. For example, if you’re sending $1000, your fees would likely be under $10. Transfers can only be made between bank accounts, so it’s a great option for those who have established bank connections in both the sending and receiving countries. As recommended by leading financial analysts, Wise simplifies cross – border payments and can help you keep more of your money in the transfer process.

Xoom

Xoom is another popular tax – friendly transfer option. It tends to have low upfront fees, especially when you use a PayPal balance or bank account to make a bank deposit. For instance, you can make a bank deposit with a $0 upfront fee when funding with a PayPal balance or bank account, instead of using a debit or credit card. This can be particularly beneficial for smaller, frequent transfers. A small business owner who needs to send regular payments to international suppliers can use Xoom to avoid high fees, making it a practical solution for maintaining cash flow.

XE Money Transfer

XE Money Transfer provides competitive exchange rates and transparent fee structures. It offers a wide range of currencies, which is ideal for those dealing with multiple international transactions. If you’re involved in global trade or have family members in different countries, XE allows you to transfer money to various destinations efficiently. An individual working in the export business may use XE to send payments to suppliers in different countries, taking advantage of its multi – currency capabilities.

Tax – free transfer scenarios

In 2025, a married couple can transfer up to $27.98 million free of federal transfer tax (Tax Foundation 2024). This represents a significant opportunity for wealthy families to transfer assets without incurring hefty tax burdens. However, it’s important to note that under current federal law, the estate/gift and GST tax exemptions are subject to change. Understanding these tax – free scenarios can be complex, but it’s crucial for those planning large – scale transfers.

Key Takeaways:

- Wise offers low fees and great exchange rates when using a bank account for transfers.

- Xoom has low upfront fees for bank deposits when funded with a PayPal balance or bank account.

- XE Money Transfer is suitable for multi – currency transfers.

- Married couples in 2025 can transfer up to $27.98 million free of federal transfer tax, but tax laws are subject to change.

Top – performing solutions include Wise, Xoom, and XE Money Transfer for those looking for tax – friendly transfer options. Try our transfer fee calculator to see how much you can save with these services.

Remittance compliance advice

Did you know that globally, banks currently only hold about 25% of the international remittance market, while fintechs and MTOs have captured the remaining share (SEMrush 2023 Study)? This shows the dynamic nature of the remittance industry, and compliance in this area is crucial for both senders and receivers.

Data sources for identifying tax – friendly options

International Transactions Reporting Systems (ITRS)

International Transactions Reporting Systems are a valuable tool for remittance compliance. These systems allow authorities to monitor foreign exchange (FX) transactions and cross – border transactions, with a particular emphasis on remittances. For example, many central banks around the world have rolled out ITRS to keep a close eye on the flow of money. In some countries, banks are required to report all international transactions above a certain threshold through these systems. This data helps in identifying any potential tax – evasion or non – compliant behavior.

Pro Tip: If you are a remittance service provider, make sure you are well – versed in the ITRS requirements of the countries you operate in. Keep track of any changes in reporting thresholds or procedures to avoid penalties. As recommended by the World Bank, using reliable ITRS can streamline your compliance process and reduce the risk of non – compliance.

Direct reporting by remittance service providers

Remittance service providers play a key role in ensuring compliance. They are often required to directly report information about the remittances they handle. This includes details such as the sender, recipient, amount, and purpose of the transfer. For instance, major providers like OFX, Xe, and Wise are expected to maintain accurate records and report them as per the regulatory requirements. This data can be used by tax authorities to assess the tax implications of remittances and identify tax – friendly transfer options.

Case Study: In a particular country, a remittance service provider that accurately reported all its transactions helped its clients save on taxes. By providing detailed reports, the tax authorities were able to correctly classify the transfers as gifts or business – related, leading to appropriate tax treatment.

Pro Tip: If you are a sender or receiver, ask your remittance service provider about their reporting procedures. A provider with a good compliance track record can offer more peace of mind and potentially help you find tax – efficient transfer methods. Top – performing solutions include providers that use advanced technology to ensure accurate and timely reporting.

Household surveys

Household surveys can also be used as a data source for identifying tax – friendly remittance options. These surveys collect information from remittance senders and recipients, such as the frequency of transfers, the amount sent, and the source of funds. This data can give a broader view of the remittance behavior within a country and help policymakers design tax – friendly regulations. For example, a survey might reveal that a significant number of remittances are sent to support family members in education. Based on this information, tax incentives could be introduced for such transfers.

Key Takeaways:

- International Transactions Reporting Systems (ITRS) are essential for monitoring cross – border remittance transactions.

- Direct reporting by remittance service providers helps tax authorities assess tax implications.

- Household surveys can provide insights for policymakers to design tax – friendly regulations.

Try our remittance compliance checker to see if you are following all the rules correctly.

FAQ

What is the annual exclusion limit in gift transfer tax rules?

The annual exclusion limit is a key part of gift transfer tax rules. As of 2023 in the U.S., donors can give up to $16,000 per recipient each year without paying gift tax (IRS 2023). This allows multiple tax – free gifts. Detailed in our [Rules for the donor] analysis, keeping track of gifts is crucial.

How to choose a tax – friendly transfer option?

When choosing a tax – friendly transfer option, consider factors like fees and exchange rates. Wise offers low fees and good exchange rates when using a bank account. Xoom has low upfront fees for bank deposits with a PayPal balance or bank account. XE Money Transfer is great for multi – currency transactions. Industry – standard approaches involve comparing these options.

Steps for international transfer reporting?

- For large transfers, banks report to relevant authorities if above a threshold (e.g., $10,000).

- FinCEN requires detailed reporting for large international transfers.

- File FBAR if you have over $10,000 in foreign bank accounts.

- File Form 3520 for gifts/inheritances over $100,000 from a foreign source. As recommended by financial regulatory tools, staying updated is essential. Detailed in our [International transfer reporting] section.

Remittance vs Gift Transfer: Which has more complex tax implications?

Remittance can have complex tax implications due to foreign income tax, double – taxation, and estate/gift tax exemption impacts. Gift transfers have rules like annual exclusion and lifetime exemption. Unlike gift transfers, remittance often involves cross – border income tax rules. According to industry experts, both require careful attention to compliance.